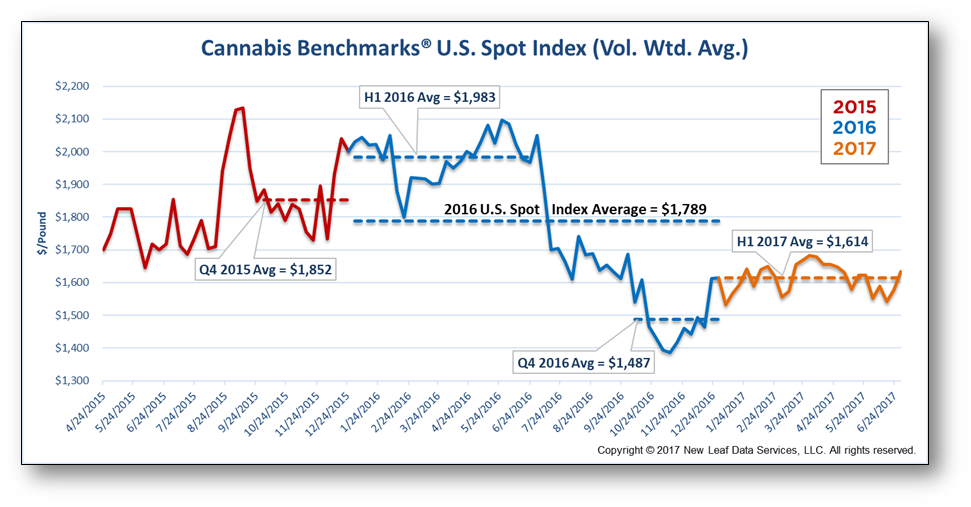

The price of a pound of legal marijuana continues to plummet in 2017, according to a new report tracking the commodity’s U.S. spot price index.

Wholesale cannabis prices dropped 18.6 percent nationwide in the first half of 2017, with Colorado prices dropping by up to 40 percent compared to the first half of last year, according to Cannabis Benchmarks’ “2017 Mid-Year Wholesale Market Report.” Similar to commodities like gold and oil, the Denver-based independent price reporting agency tracks spot prices — the current value in the marketplace at which an asset can be bought or sold for immediate delivery.

Despite the overall decline, marijuana prices showed “remarkable” stability considering last year’s price volatility and recent political uncertainty, the analysts found. For the first six months of this year, there has only been a $150 difference between the low and high prices for legal cannabis nationally, compared to nearly $300 separating the lows and highs during the first half of 2016.

The U.S. Spot prices for wholesale cannabis opened the year at $1,532 a pound, up from the 2016 annual low of $1,386 per pound. However, based on 2015 and 2016 wholesale prices, the firm expects further price declines through November as seasonal fall harvest hits the market.

“We still do expect to see a seasonal price depression nationally that comes with the harvest,” report author Adam Koh told The Cannabist.

While drastic, the 40 percent decline in Colorado wholesale prices follows the national trend of lower prices in all five states with legal adult-use markets — despite the fact that demand remains strong in those states. Cannabis Benchmarks attributes the trend to a business boom that has increased competition for market share and customers, which in turn creates “more than adequate” production. Likewise, those businesses are, by necessity, becoming more efficient and cost-effective in their cultivation and manufacturing “in order to compete and stay afloat.”

The patchwork quilt of state-based marijuana regulations causes prices to vary wildly across borders. The highest average wholesale prices in the U.S. for legal cannabis during the first half of 2017 were in Alaska, at $4,190 per pound; the lowest were in Colorado at $1,280 per pound.

In Colorado, the country’s most mature market with three-plus years of adult-use sales, the price per pound of wholesale cannabis has dropped from a 2016 high of $1,994 to a 2017 six-month low of $1,181. Cannabis Benchmarks attributes declines in part to the state’s “liberal approach to licensing and production,” which has led to dramatic increases in the volume of marijuana grown and produced.

On the other hand, wholesale prices in Washington, another maturing market, have turned around from last year’s “figurative bargain basement,” according to the report. The state’s monthly spot index prices for the first half of this year averaged $1,387 per pound, a rise of about eight percent compared to the fourth quarter of 2016.

California’s fast-approaching legalization is causing significant uncertainty in pricing for the fourth quarter, Koh said.

While California officials scramble to have regulations in place ahead of the state’s scheduled January 1 launch of legal adult-use sales, Cannabis Benchmarks believes only a “small fraction” of commercial cannabis transactions during 2018 will take place within the licensed marketplace. The report cites the state’s vast black market, which will continue to provide producers other venues in which their cannabis can fetch higher profit margins.

“There appears to be a significant portion of the state’s cannabis commerce that won’t (be licensed), Koh said, “and there will be stiff competition for those operators working to comply with state laws.”

Nevada remains another conundrum for the firm’s spot-price indexing efforts. Adult-use sales kicked off on July 1, however the state’s “unique regulatory circumstances” created supply chain struggles that prevented any wholesale price increases during the first half of 2017, according to Cannabis Benchmarks.

The cash-only nature of legal cannabis transactions presents a common drag on wholesale prices across the country, according to the report. Cannabis companies are prohibited from accessing the federal banking system, limiting businesses’ ability to transact larger deals, according to Cannabis Benchmarks’ analysis.

“In such a landscape,” the report says, “the significant amount of cash required to settle a deal greater than 20 pounds is often not at hand.”