California passes $1 billion in cannabis tax revenue two years after launching legal market

Millions go to child care, public safety and research, but growth stagnates as regulated industry struggles to compete.

Millions go to child care, public safety and research, but growth stagnates as regulated industry struggles to compete.

Millions go to child care, public safety and research, but growth stagnates as regulated industry struggles to compete.

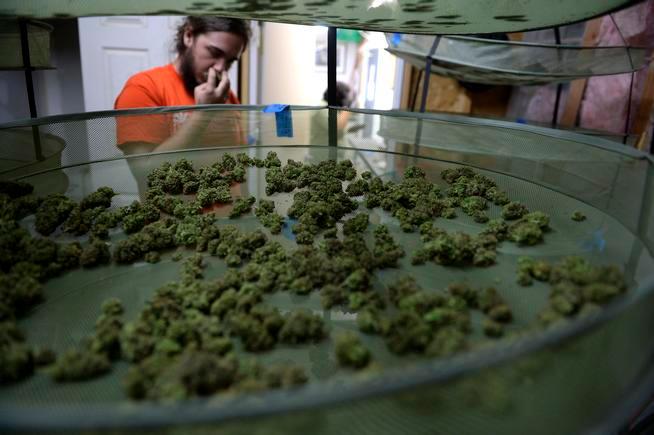

Marijuana sales in Colorado have exceeded $1 billion as of August of this year, with tax revenue from those sales coming in at $200 million, according to a report.

Police in Colorado communities will divvy up $21.5 million in aid from Colorado to steer those struggling with drug addiction toward treatment and housing.

Legalizing marijuana nationwide would create at least $132 billion in tax revenue and more than a million new jobs across the United States in the next decade, according to a new study.

The Eagle County tax on recreational marijuana could generate an estimated $2 million annually, with the first $1.2 million earmarked for mental health and substance abuse programs in the Eagle River and Roaring Fork valleys.

Canadian provinces expect to see the country reap significant revenue from the sale of legalized marijuana, and are pushing for a bigger cut of the tax windfall.

State tax officials say the first month of legal sales of recreational marijuana in Nevada brought in more than $3.5 million in tax revenue.

Milliken officials point to Garden City, a Weld County town that credits marijuana for half its annual revenue — $1.3 million last year — as a model for the community.

Marijuana advocates are trumpeting a Colorado milestone: More than $500 million in revenue for the state since recreational cannabis sales started in 2014.

Assessing the swift rollout of Nevada recreational marijuana sales: A rudimentary distribution system created supply issues, and high demand confirmed state officials’ sense that tax revenue would help state coffers.

SALEM, Ore. — The marijuana business in Oregon is becoming a bonanza for the state. The Oregon Department of Revenue announced Tuesday it received $5.3 million in marijuana tax payments in January. The grand total of $65.4 million received in the year since Oregon started taxing pot sales is blowing…

As marijuana revenues trickle into the state, slow to meet projections, a few Colorado school districts are among the first to see some impact from the state’s new funds.

Tax revenues from Colorado’s medical and recreational marijuana sales in February increased from the previous month, according to figures released Wednesday by the state.

Colorado’s police chiefs are asking the state for more money to pay for marijuana enforcement, saying they are “disappointed” in Gov. John Hickenlooper’s plan for how to spend marijuana tax revenue.

Handed a budget proposal that predicts sky-high marijuana tax revenue, Colorado lawmakers say they will move cautiously in deciding how much to spend.

A southern Colorado county with two recreational marijuana stores has become the first in the state to announce tax totals from the new industry. Pueblo County finance authorities announced that its two shops had about $1 million in total sales in January, producing about $56,000 in local sales taxes.

A new report finds that legalizing and taxing marijuana boosts revenue for state and local governments, but not by much.

Gov. John Hickenlooper is preparing to release his state budget for the next fiscal year on Nov. 3 — the day before Election Day — raising the stakes on whether he will support returning money to taxpayers. The potential for a refund on pot taxes via TABOR adds a complication in state budget negotiations.

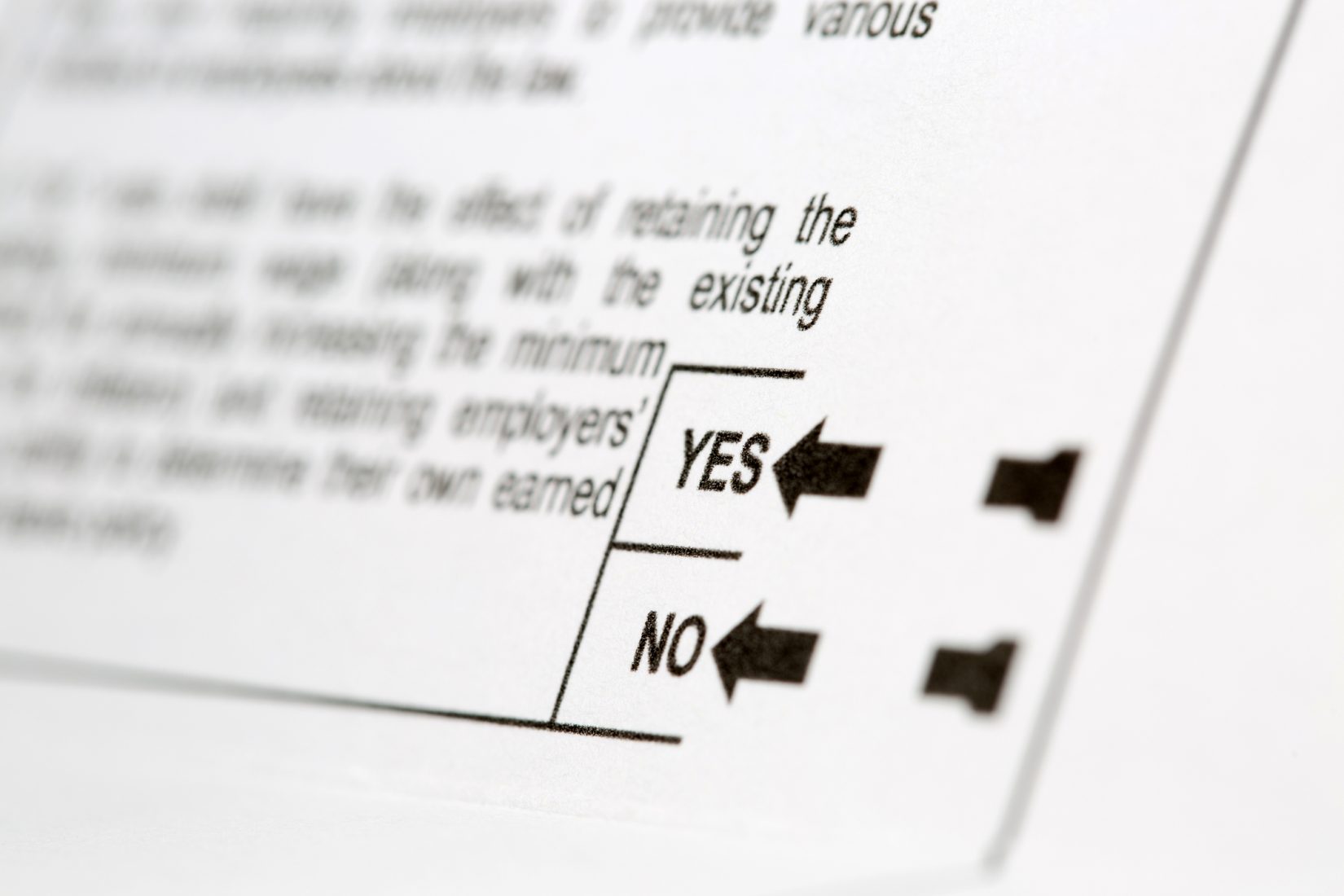

Colorado voters approved the sale of legal marijuana thinking the revenues derived would go towards areas like schools or treatment for substance abuse.

Excise taxes for marijuana sold for adult recreational use exceeded alcohol excise taxes for the first time in Massachusetts, reflecting growing marijuana sales that reached $2.54 billion, according to the Cannabis Control Commission.

Changing the way Massachusetts taxes legal marijuana could produce more revenue for the state, but it could also disrupt the fledgling cannabis industry, a report found.

Legislative Analyst’s Office calls for taxing marijuana based on potency and dropping cultivation taxes.

Legislative Analyst’s Office calls for taxing marijuana based on potency and dropping cultivation taxes.

Prop. 64 money funneled to child care vouchers as after school programs struggle to stay afloat.