The Colorado Division of Banking, following through on a commitment to reduce paperwork, will no longer require banks it oversees to file what are known as suspicious activity reports.

The reports are required by federal regulators, and until this month, banks also had to file the same documents with the state.

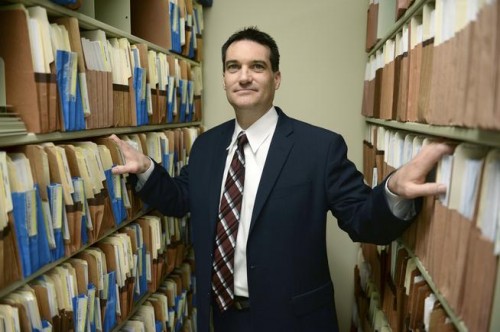

“In July of 2015 when I was appointed I vowed to look for ways to cut unnessary regulation,” said Colorado Banking Commissioner Chris Myklebust.

“The SARS reports were already being filed with federal regulatory agencies and we were requiring the banks to file them with us within three days of their federal filings. But it’s unnecessary,” he said. “We can access those same reports from the federal regulators.”

Under federal anti-money laundering and secrecy laws, any “money services businesses,” which include banks and even precious metals dealers, have to file suspicious activity reports alerting the feds to potential illegalities.

Banks that provide services to marijuana businesses and dispensaries have to file the reports noting anything unusual or alarming about client activity.

Pot banking issues

Op-ed: Leadership needed to fix pot banking issue before lives are lost

Tax money court fight: IRS will refund fines to Denver pot shop that pays tax in cash

Special deliveries: Discreet couriers keep precious cannabis cargo on move in Colorado

Weed news and interviews: Get podcasts of The Cannabist Show.

Subscribe to our newsletter here.

Watch The Cannabist Show.

Myklebust says he advises banks to file reports for nearly every marijuana-related transaction, even if it’s not suspicious, just to cover any potential investigative action by federal banking regulators.

Because no state banking rules governing pot businesses have been approved by federal regulators, banks who provide services to the marijuana industry are operating in a gray area.

Jenifer Waller, senior vice president of the Colorado Banking Association, said any efforts to reduce the heightened regulatory burden banks have faced since the financial crisis are welcome.

“We greatly appreciate the (banking) commission going through the exercise to see where things can be tweaked,” she said.

Jerd Smith: 303-473-1332, smithj@dailycamera.com or twitter.com/jerd_smith