Colorado’s cannabis industry is on pace to generate north of $213 million in state tax revenue by 2019, according to the Colorado Legislative Council’s latest economic and revenue forecast released this week.

By The Cannabist’s calculations, that amounts to nearly $1.7 billion in sales of flower, concentrates, edibles and other infused products in the recreational and medical marijuana markets.

But what’s in a number?

This fledgling industry is laden with projections, estimates and forecasts. Multibillion-dollar figures have been ascribed to locales where a single legal adult-use sale has yet to even take place.

In Colorado, pot shop cash registers have been ringing up recreational transactions for nearly three years. As such, the state has accumulated valuable data.

We know that Colorado’s marijuana industry has topped $1 billion in sales through the first 10 months of 2016.

Analytics have grown more robust, and there’s a greater grasp on the delicate interplay of factors such as price, supply, demand, consumer preferences, local-specific regulations and seasonal variation.

“Here in Colorado, it’s not so nebulous,” said Miles Light, a University of Colorado economist who co-founded the Denver-based Marijuana Policy Group, an independent economic and market research firm that was commissioned for studies by the state of Colorado. “But in other states? Not so much.”

Assumptions, blind speculation and the incorrect application of Colorado-specific data have resulted in overestimations by new marijuana markets such as Canada, Nevada and Florida, Light said.

When Colorado initiated and implemented legal recreational marijuana sales — a first-of-its-kind action — there were “silly mistakes” in some of the initial models, economic forecasts and projections, he said.

“But these mistakes keep happening even today,” Light said.

The Cannabist takes a look back at the revenue projections made in advance of Colorado’s groundbreaking marijuana legalization, how the sales stacked up, where the latest projections stand and the challenges that have popped up here and elsewhere since.

Early estimates

In February 2014, a few weeks into Colorado’s little experiment with legal marijuana, came a big and bold proclamation from the state’s governor:

Colorado could very well stuff its coffers with nearly $134 million in tax and fee revenue during the first full fiscal year of legal adult-use sales.

Just shy of the program’s first 100 days, Gov. John Hickenlooper walked back those projections by more than $20 million after getting a read of the January 2014 marijuana tax revenue report that fell short of early projections.

Still, even that revised estimate was quite bullish as compared to others tossed around in the pre-legalization period. Reports published prior to and following the voter-approved passage of Amendment 64 in 2012 and the related Proposition AA — a 2013 measure establishing two new state taxes on marijuana — predicted annual tax collections in the realm of $5 million to $80 million.

Colorado generated about $88 million in state tax revenue during that first 2014-15 fiscal year (July to June), according to state revenue records. In FY 2015-16, the tax revenue jumped 60 percent to $141.3 million.

More: Colorado marijuana sales

Milestone: Colorado marijuana sales top $1 billion in first 10 months of 2016

In context: Colorado weed is now a behemoth with a $2.4 billion economic impact

Op-ed: Why pot taxes can’t solve Colorado’s budget problems

Weed news and interviews: Get podcasts of The Cannabist Show.

Subscribe to our newsletter here.

Watch The Cannabist Show.

Peruse our Cannabist-themed merchandise (T’s, hats, hoodies) at Cannabist Shop.

The gap in the initial state calculations was rooted in a thought that all of the demand — estimated by various groups to be between 57.4 metric tons and 121.4 metric tons of cannabis — would be in the regulated space, said MPG’s Light. In reality, a share of that demand would be seen by the regulated market and gradually climb as those sales transferred away from the black market.

“Those (2014 numbers) are off because the cannabis market is new, it’s evolving and local-level decisions impact the market dynamics a lot more (than demand projections),” said Andrew Livingston, policy analyst at cannabis law firm Vicente Sederberg.

When a city like Boulder extends hours of operation, or Aurora allows retail sales, or, if in the future, the state allows delivery, all of those actions could spur growth in demand, he said.

“In my mind, most of the levers in the market that would impact change of demand and thus a change in the amount of tax revenue … those are also likely going to be determined by local-level decisions,” Livingston said.

Predicting tax revenue no simple task

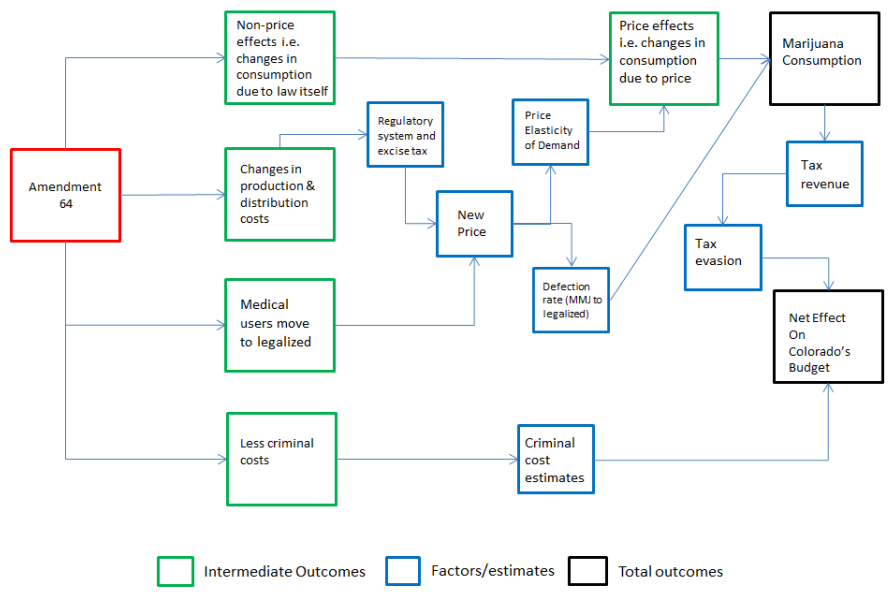

In its 2012 report in advance of Amendment 64, the Colorado Center on Law and Policy’s flow chart (see below) showed how roughly a dozen potential factors — among them price elasticity and demand, production and distribution changes, consumption changes, tax evasion, medical patients switching to the recreational market — could affect marijuana consumption and, ultimately, the net effect on Colorado’s budget:

“Higher regulatory costs on the producer will cause a higher new price. This higher new price influences the number of users who would switch from medical marijuana to newly legalized products. Price affects consumption and a more expensive product will have a downward effect on consumption. Higher taxes will also create greater incentives to evade taxes. Any adjustment in the blue factors in the model will indirectly impact the final outcomes.”

The Colorado Center on Law and Policy projected $47.3 million in new revenue for FY 2014-15, an estimate that did not include the 10 percent special sales tax proposed later via Proposition AA, said report author Chris Stiffler, who is now at the Colorado Fiscal Institute. Stiffler accurately predicted that state revenue from the 15 percent excise tax on wholesale marijuana transfers would total $24 million in that first year.

Other counterparts, including the Colorado Futures Center, also projected that the excise tax revenues would not surpass $40 million in its first year — in the Amendment 64 proposal, the first $40 million of annual returns are earmarked for school construction projects. Anything above that goes into a designated school general fund.

“It took us two years or so to get to that $40 million” and the subsequent overspill, Stiffler said.

The excise tax projections may have been spot-on, but public perception has been murkier. Stiffler and others have addressed the misconception that marijuana tax revenue — a drop in the bucket of the state’s overall revenue — would solve schools’ perennial budget woes.

In Arizona, the campaign opposing marijuana-legalizing Proposition 205 ran television ads claiming that Colorado schools never received any money from marijuana. Colorado legislators later publicly refuted those claims and called for the campaign to cease making such assertions.

Colorado reached that $40 million target in FY 2015-16, according to Department of Revenue data, and is well on its way to surpassing that in FY 2016-17.

Big returns

Be it fiscal year or calendar data, no matter how you slice it, Colorado’s cannabis industry has hit its stride.

The Cannabist’s tracking of tax revenue and sales for the first 10 months of 2016 reveal a $1 billion industry that’s repeatedly setting new records and has already outpaced 2015’s $996 million in sales.

Useful weed resources

Strain reviews: Check out our marijuana reviews organized by type — sativas and sativa-dominant hybrids, ditto with indicas.

Favorite strains: 25 ranked reviews from our marijuana critics

Follow The Cannabist on Twitter and Facebook

The industry’s current growth trajectory — barring any significant changes on the federal level — is expected to continue in Colorado, according to the latest projections released this week by the state. The Colorado Legislative Council mapped out projected state revenue in its 115-page economic forecast.

The council’s marijuana tax estimates for upcoming fiscal years break down like this:

• $188 million for FY 2016-17

• $193.9 million for FY 2017-18

• $213.8 million for FY 2018-19

That translates into sales of nearly $1.4 billion, $1.5 billion and inching toward $1.7 billion, respectively, according to calculations made by The Cannabist.

But as with a lot of facets of this emerging industry, those numbers could be moving targets.

“We really don’t know how consumers’ tastes and preferences for cannabis are going to change,” Livingston said.

In addition to a potential market plateau, consumers will be paying less tax starting July 1, 2017, when the special sales tax rate drops to 8 percent from 10 percent.

Errors early on

The many predictions and projections for cannabis markets are not without controversy.

The Marijuana Policy Group utilizes methods rooted in economics and statistics to assist governments on policy-making efforts and help businesses better understand the marketplace.

Light, who has a doctorate in economics, bristles at some of the “eye-popping” projections looking four years out, how they sometimes spread like wildfire in the media, and the potential negative consequences they have on current decision-making efforts.

“The perception becomes reality,” he said, cautioning against building policy around conjecture.

In Canada, the reputable CIBC World Markets Inc. overshot potential tax revenue by 300 percent, Light said.

The CIBC study released in January suggested that tax revenues in Canada would be more than $142 CAD ($106 USD) per resident, amounting to more than five times the highest tax yield in the United States, Light said, noting per-resident revenues in Colorado, Washington and Oregon were $23, $18 and $6 in the first year of legalization.

The broad acceptance of this report shows how the press remains unfamiliar with the legal cannabis market, and can easily be misled, especially when the reports come from institutions that are perceived to be reputable, Light said.

Although Colorado has served as a model for other states and nations now navigating marijuana legalization, those new markets make errors by applying Colorado’s results to their respective locales, he said.

Colorado is surrounded by a large sea of prohibition states, which results in inflated visitor demand, he said. Whereas a state such as California, will be almost completely surrounded by legal states — so the visitor metrics in Colorado wouldn’t really apply.

Wrong estimates could have drastic consequences, Light said, noting a state of Nevada report that projected that medical marijuana patients would demand 208 metric tons of marijuana. By Light’s estimates, that figure is probably 500 percent to 800 percent too high for the state for a combined medical and recreational market.

The ramifications of such an oversupply include risk of increased diversion to other states and violation of the federal Cole memorandum, risk of an Oregon-style glut and high business failure, and low prices among vendors “which is good in a regular market, but is not 100 percent ‘good’ when the market is a controlled substance,” Light said.

So what’s the upshot for states that are now establishing regulations for the legal market?

For newly legal states, Light recommended that officials first conduct research to determine market demand and then also utilize industry experts to help dial in those calculations and assumptions.

“The market is mature enough for legitimate data-backed analysis,” he said.